Paye

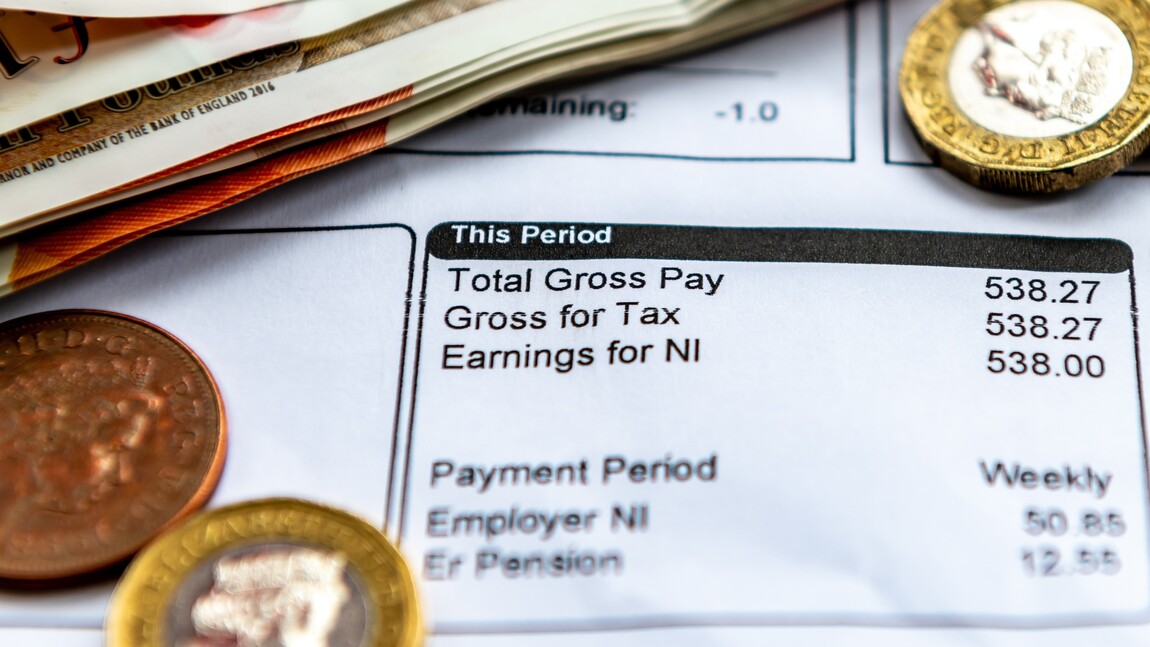

If your business employs staff, you are responsible for operating Pay As You Earn (PAYE) correctly. This includes deducting the right amount of tax and National Insurance from wages, paying it to HMRC, and keeping accurate records. Because of its complexity, PAYE is a common focus for HMRC investigations.

If you’ve received notice that HMRC is reviewing your PAYE records, it’s important to act quickly and seek expert advice. At Tax Investigation Helpline, we help businesses navigate PAYE enquiries and protect themselves from penalties, disruption, and unnecessary costs.

Why HMRC Investigates PAYE

HMRC checks PAYE systems to ensure employers are meeting their obligations. An investigation may be triggered if:

- Your payroll records contain errors or inconsistencies.

- Staff are incorrectly classified (e.g., treated as self-employed when they should be employees).

- Benefits in kind are not properly reported.

- Real-Time Information (RTI) submissions are late or inaccurate.

- There are large or unusual fluctuations in PAYE liabilities.

These reviews can range from a straightforward desk check to a full employer compliance visit, where HMRC inspects payroll, contracts, and other employment records.

What’s at Risk in a PAYE Investigation PAYE investigations can have serious consequences for employers:

- Backdated tax and National Insurance liabilities if HMRC believes deductions were underpaid.

- Substantial penalties and interest charges.

- Reclassification of contractors or freelancers as employees, leading to additional liabilities.

- Increased scrutiny across other areas of your business, such as VAT and corporation tax.

Even if you’ve made genuine mistakes, HMRC can impose penalties unless you can show you took reasonable care. Without expert support, it can be difficult to defend your position.

How We Help

At Tax Investigation Helpline, we have extensive experience in handling PAYE investigations. We offer:

- Immediate clarity: We explain HMRC’s letter or request in straightforward terms, so you know what you’re facing.

- Direct representation: We deal with HMRC on your behalf, ensuring responses are accurate and protecting you from unnecessary exposure.

- Detailed review of payroll records: Our specialists identify potential issues before HMRC does and prepare a robust defence.

- Negotiation and settlement: Where errors exist, we work to reduce penalties and arrange manageable repayment terms.

- Protection against overreach: If HMRC attempts to push beyond its powers or make excessive claims, we challenge them firmly.

Our priority is always to secure the best possible outcome for you with minimum disruption to your business.

Common PAYE Issues We See From our experience, the following are frequent triggers for PAYE investigations:

- Misuse of self-employed or subcontractor arrangements.

- Errors in reporting staff benefits and expenses.

- Failure to keep proper payroll records.

- Mistakes in Real-Time Information (RTI) submissions.

- Cash payments to staff not properly reported.

Understanding these patterns allows us to anticipate HMRC’s approach and prepare accordingly.

Don’t Face HMRC Alone PAYE rules are complex, and HMRC investigators are trained to identify weaknesses in payroll systems. Trying to manage an investigation without expert support can leave you exposed to costly errors. By having us represent you, you can be confident that your business is defended and that matters are resolved efficiently.

We’ve guided countless employers through PAYE investigations, from small businesses to large organisations. Whatever your situation, we’ll provide the expertise, reassurance, and protection you need.

Contact Us Today

If HMRC has contacted you about a PAYE investigation, don’t delay. The earlier you act, the better your chance of reducing liabilities and penalties. Call Tax Investigation Helpline today for a confidential consultation. We’ll handle the pressure so you can focus on running your business.